Bitcoin is experiencing a downturn in the short term, which could mean that it is throwing up a large part of its recent profits, even though the long-term outlook looks healthy for the world’s no. 1-crypto.

This is the opinion of a number of analysts to bitcoin prices BTCUSD,

violated a major technical level following the exuberance of digital assets in the wake of Coinbase Global’s COIN,

listing on the Nasdaq last week.

Bitcoin was 1.8% lower in New York late Wednesday morning, exchanging about $ 56,000 on CoinDesk. This puts the crypto about 14% below its everyday peak at $ 64,829.14.

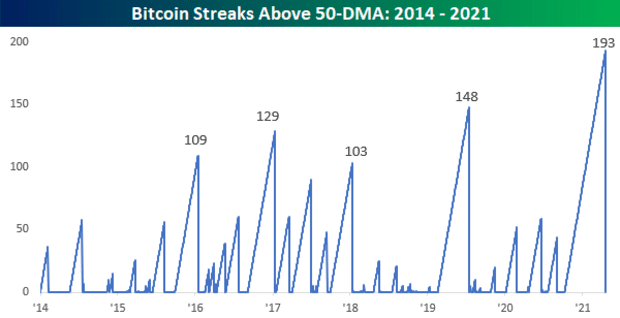

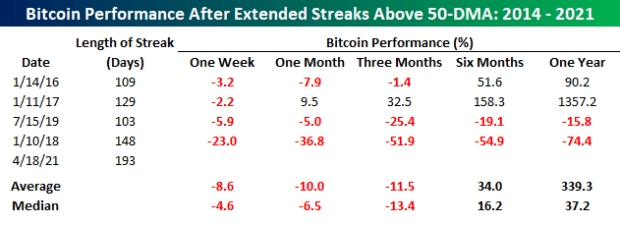

On Tuesday, researchers from Bespoke Investment Group noted that Tuesday was bitcoin’s first time, in a 24-hour period, in which it had fallen below its 50-day moving average since at least 2014, after hitting 193 straight-day prints above the level recorded. Bitcoin was first created in 2008-09.

Market technicians use moving averages as barometers of bullish and bearish trends in an asset.

Company Investment Group

Delta Exchange CEO Pankaj Balani commented in an email that bitcoin had managed to keep recent trading above its 50-day moving average, but warned that a sustained breach of the short-term price to ‘ could lead to a drop of about $ 40,000.

The ’50 DMA has been a major supporter of Bitcoin since October last year and he has kept that support in this rally every time. This time, however, we see that the momentum of Bitcoin is becoming entangled and that BTC is struggling to maintain this support, ‘Balani explained.

The tailor-made researchers noted that bitcoin tends to see declines in the period of one week, one month and three months, after breaking upward trends of at least 100 days.

“A week later, [bitcoin] was already four times lower for an average decline of 4.6% and has already fallen four times. One and three months later, the performance was even worse with the average decline of 6.5% and 13.4% respectively, ”the report reads.

Company Investment Group

Researchers at JPMorgan Chase & Co. JPM,

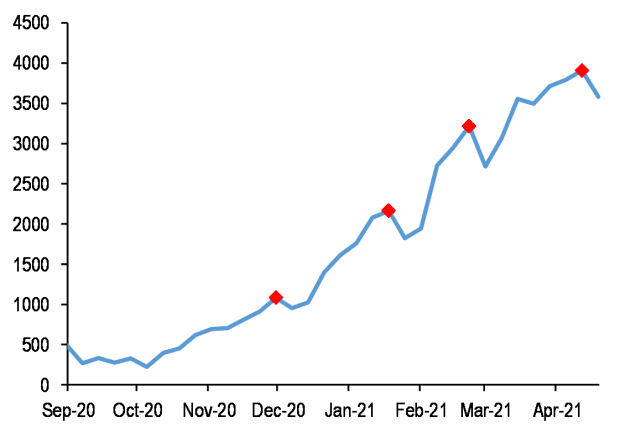

Nikolaos Panigirtzoglou included, wrote in a Tuesday report that the declining momentum for bitcoin could cause a lower spiral for the volatile asset. According to analysts, a failure to recover $ 60,000 could lead to a sharp drop.

The JPMorgan strategist points to bearish trends in bitcoin futures markets BTC.1,

where institutional and professional investors will hedge their exposure to the crypto.

JPMorgan’s Figure 9 Bitcoin Chart

Referring to the attached chart, JPMorgan says that the four deliveries of more than a 10% drop in their futures position for the future position, including the past few days, are attributed to the inability to move higher.

‘Similar to the previous three episodes, it is likely that momentum traders, such as [commodity trading advisors] and cryptocurrencies, have been at least partially behind the build-up of long bitcoin futures over the past few weeks and therefore probably also behind the settlement over the past few days, ‘JPMorgan concluded.

“If the bitcoin price does not break out of $ 60,000 any time soon, the momentum signals shown in Figure 9 will obviously decline for a few months from here, given their ever-increasing level,” the analysts wrote.

JPMorgan researchers are not 100% sure that bitcoin will follow a decline this time with a strong setback as seen in November and mid-February. The analysts in particular say that the flow in bitcoin was last and that the downturn was gaining steam.

So far this year, bitcoin prices have been live, up 94%. For comparison, gold GC00,

which is considered a competitor of bitcoin, fell by 5.5% in 2021. The Dow Jones Industrial Average DJIA,

and the S&P 500 index SPX,

are both about 11% higher in the year so far.