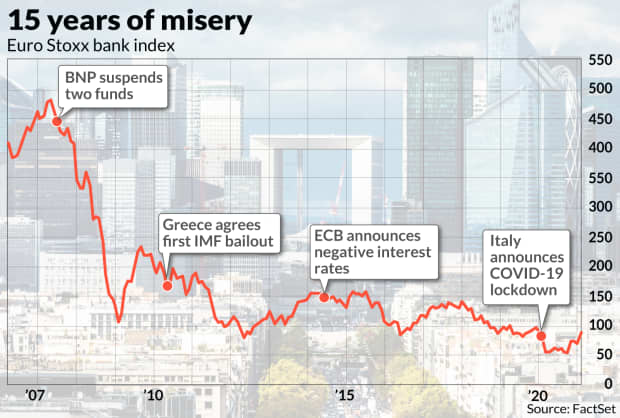

It has been a rather rough 15 years for the leading banks in the eurozone.

The bad times were terrible – the financial crisis of 2008, the Greek debt crisis, and now the COVID-19 pandemic. But even the good times were not yet so great, while lenders in the group of 27 countries have a background of negative interest rates and stagnant local economies. The Euro Stoxx banks index SX7E from its peak in 2007 to its lowest in 2021,

collapsed by 89%.

But suddenly there is life in the grouping led by the French BNP Paribas BNP,

Spain’s Banco Santander SAN,

Italy’s Intesa Sanpaolo ISP,

and the ING INGA of the Netherlands,

thanks to the increase in bond yields. France’s yield for ten years TMBMKFR-10Y,

now flirts regularly with a positive area, and Goldman Sachs expects Germany’s yield rate TMBMKDE-10Y,

which has been negative for almost two years may be zero by the end of the year. Since just before the US election, on October 29, the sector has risen by 71%.

It was just bad news and worse news for eurozone banks.

The question, then, is whether this refusal is real or not. There were other times that the sector had large upward movements, especially in 2009, before reversing lower.

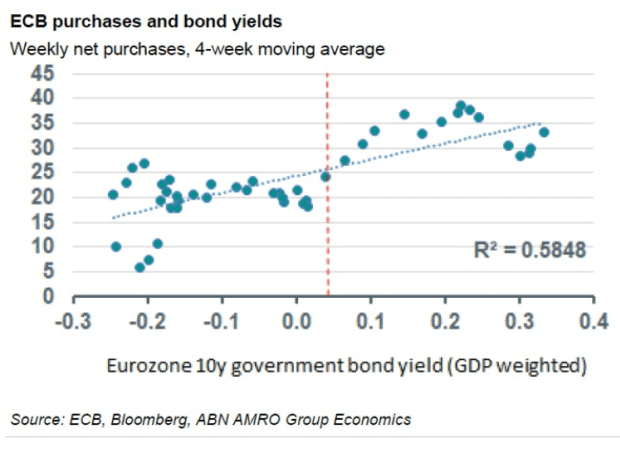

And there is a compensatory force. The rise in bond yields has angered the European Central Bank, which, unlike the US Federal Reserve, feels the moves could hamper economic recovery. ECB President Christine Lagarde, chief economist Philip Lane and board member Isabel Schnabel all expressed concern about the rise.

The ECB meeting on Thursday gives Lagarde another opportunity to sharpen the yield on the bonds, if no action is taken. Analysts believe the central bank still has more than enough firepower under current authority to record its bond-buying activity under the Pandemic Emergency Purchase Program.

The current yield is about where the ECB has accelerated purchases in the past, says Nick Kounis, head of financial market research at Dutch bank ABN Amro. “We think an increase in the rate of net asset purchases is the first and most obvious outcome for the ECB,” he said.

Thus, an active ECB could jeopardize the emerging recovery for eurozone bank shares.

‘It’s cheap, the question is whether the style value will still get a bit of a grip and be helped by a cyclical recovery for European banks. A steeper curve may help, but the ECB will take action this week, ‘said Sebastien Galy, senior macro strategist at Nordea Asset Management.

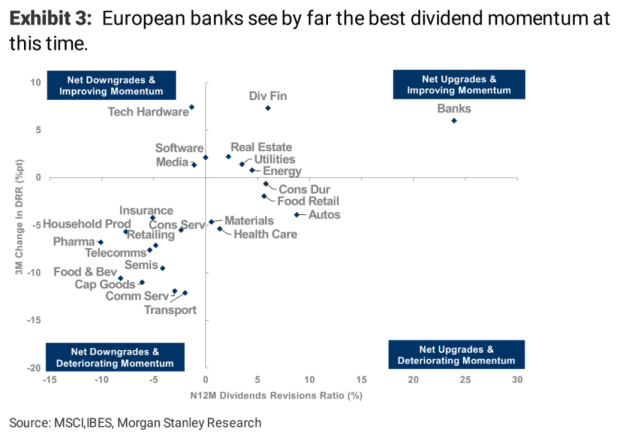

The banking history of the eurozone holds more than bond yields. Dividend payments are virtually banned by the ECB until the end of September, but analysts are now raising expectations for payouts, according to data from Morgan Stanley.

And as Galy mentioned, the valuation is not demanding. According to FactSet, banks in the eurozone trade at 0.6 times the book value. Compare this with the US, where the SPDR S&P Bank ETF KBE,

has a price of 1.2 of the book.