According to Jefferies analysts, stock market skeptics, fearful that they will experience the peak of everyday highs for a turbulent 2020, could be fueled by an unfounded round of investor euphoria.

Skepticism is understandable, they acknowledged in a Saturday note that market performance at the end of 2020 ‘is almost the opposite’ of the declines in the fourth quarter of 2018, despite comments and news flow ‘showing similar dullness. ”

Must know: As 2021 approaches, look out for a Y2K-style stock market correction, says the strategist

The S&P 500 SPX,

fell by 14% in the last quarter of 2018, a sell-off caused by fears that the Federal Reserve would stifle too strict monetary policy. The benchmark index has risen more than 10% so far in the last quarter of 2020, despite rising cases of coronavirus threatening to derail an economic recovery, even as vaccines are rolled out across the US and much of the world.

Coronavirus update: US has more than 19 million COVID-19 cases and Fauci worries about a boom after the holidays

Most importantly, equities are about future earnings. And the ‘significant difference’ in the last three months of 2020 is that earnings for the period were positive almost every week of the quarter, the analysts write.

“We would argue that this is one of the major headwinds for equities, as the review of earnings is rarely positive,” they said.

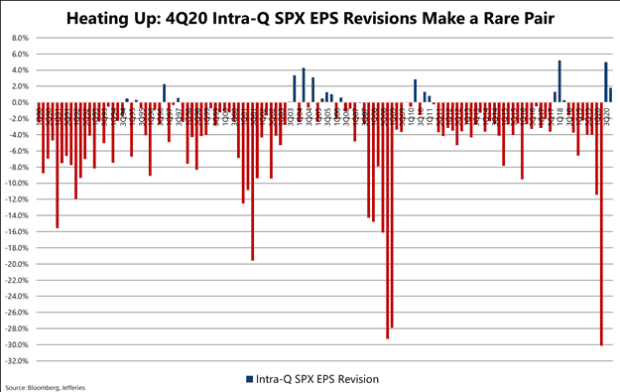

Earnings revisions refer to changes in analysis estimates for corporate earnings in a quarter – in this case for the companies that make up the S&P 500. Usually, expectations are revised lower over the course of a quarter, effectively lowering the measure when the earnings season gets underway.

As the graph below shows, upward changes have become a rare occurrence. However, history shows that stocks tend to follow the upside when it does occur, analysts said.

Jefferies

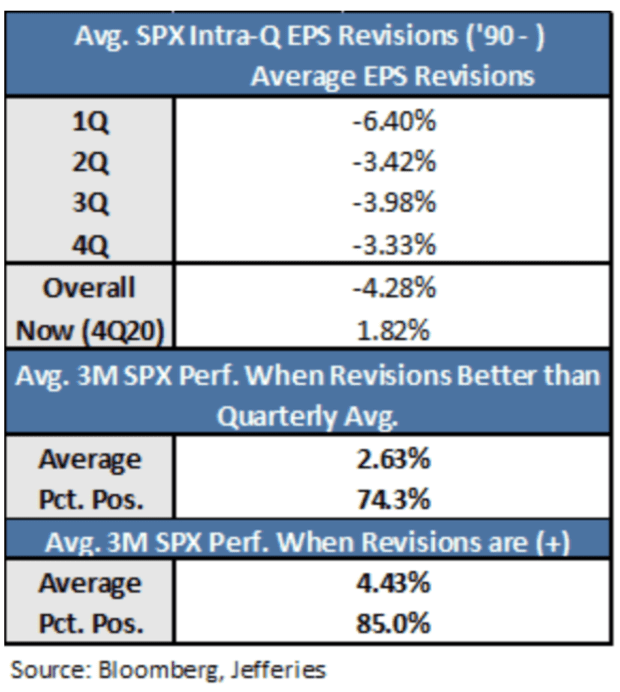

How much of a tailwind? Analysts say the three-month average S&P 500 performance in the wake of positive reviews is close to 450 basis points, or 4.5 percentage points, “which is promising” for the S&P 500 in the first quarter of 2021 (see table below ).

Jefferies

And since vaccine use has just begun, the potential for additional positive reviews remains in the first half of next year, they said.

Related: Stock market professionals have a difficult time with the presentation of a slump of S&P 500 in 2021

As can be seen from the table above, even negative reviews that are smaller than average lead to the good performance of the S&P 500. It is only when the reviews start to turn significantly, then the performance tends to slow down.

So full steam ahead for 2021? Not so fast.

Analysts said the volume of strong gains in December, with the S&P 500, has risen more than 3% in the month so far, while the Dow Jones Industrial DJIA,

increased by approximately 2.8% and the Nasdaq Composite COMP,

more than 5.5%, the scene could take place for a brief setback in January.

See: It started with ‘Santa Claus’ – why few sessions of 7 sessions are so positive for the stock market

“The current performance in December is about 50 basis points above the average since ’90, and then the performance in January is only positive about half the time,” they noted. In those cases, however, performance in the first quarter was stronger than typical, with the S&P 500 rising more than 80% of the time.

‘So while [near-term] returns can be poor, it can also be a good time to increase exposure, ”they said.