Cupertino, California Apple today announced the Apple Card Family, an innovative new way for people to share their Apple Card, track purchases, manage expenses and build credit with their Family Sharing group. Available in May in the US, Apple Card Family allows two people to have a co-owner of an Apple card, and share and merge their lines of credit while building credit at the same time. Apple Card Family also allows parents to share Apple Card with their children, while offering optional spending limits and controls to learn smart and safe financial habits. Apple Card Family is designed to help the Family Sharing Group lead a healthier financial life by making it easy to track expenses on iPhone and with one monthly bill.

‘We designed Apple Card Family because we saw the opportunity to rediscover how spouses, partners and the people you trust most share credit cards and build credit together. ‘There is a lack of transparency and understanding of the consumer in the way credit points are calculated when there are two users of the same credit card, as the primary account holder gets the advantage of building a strong credit history while the others do not,’ says Jennifer Bailey, Apple’s vice president of Apple Pay. “With the Apple Card Family, people can build up their credit history evenly.”

Apple Card is the first credit card designed for the iPhone and to help people lead a healthier financial life. Built into the Apple Wallet app on the iPhone, Apple Card has changed the entire credit card experience by simplifying the application process and eliminating all fees,1 encourage users to pay less interest and offer a new level of privacy and security.

Apple Card also offers Daily Cash, which gives up to 3 percent of each purchase as cash on users’ Apple Cash card every day.2 And without credit card number, CVV security code, expiration date or signature on the card, the titanium Apple card is more secure than any other physical credit card.

Apple Card Family Management

- Apple Card customers can add up to five people to their Apple Card account by sharing Apple Card in Wallet with them. All users must be part of the same family sharing group to be invited to the Apple Card Family and be 13 years or older.

- Apple Card can be shared with any eligible customer who is 18 years or older as a co-owner, offering both the opportunity to compile credit history, gain the flexibility of a joint limit, provide transparency in each other’s spending , share the responsibility to make payments, and provide the convenience of a single monthly bill to pay.3

- Apple Card can be shared with anyone 13 years or older as a participant, so they can learn how to spend independently and responsibly, while giving co-owners transparency and features that provide insight into purchases and control over their purchase limit. Participants over 18 can also accept credit reporting.

- All account activity, including positive or negative payment history, will be reported to credit bureaus for credit card takers, as well as all co-owners of Apple Card.

- Existing Apple Card customers can also merge their Apple Card accounts, which offer the flexibility of a higher shared credit limit, while maintaining the lower APR of the two accounts.3

- Co-owners and participants will each receive daily cash for their Apple Card purchases.

- Apple is working with Goldman Sachs as the issuing bank for Apple Card, which makes all qualification and credit decisions as part of the Apple Card Family.

Unlimited daily cash with Apple Card

Daily cash is added to users’ Apple Cash card every day and can be used immediately for purchases with Apple Pay, to make their Apple Card balance or to send it to friends and family in Messages. Apple Pay is now accepted in more than 90 percent of stores in the US.

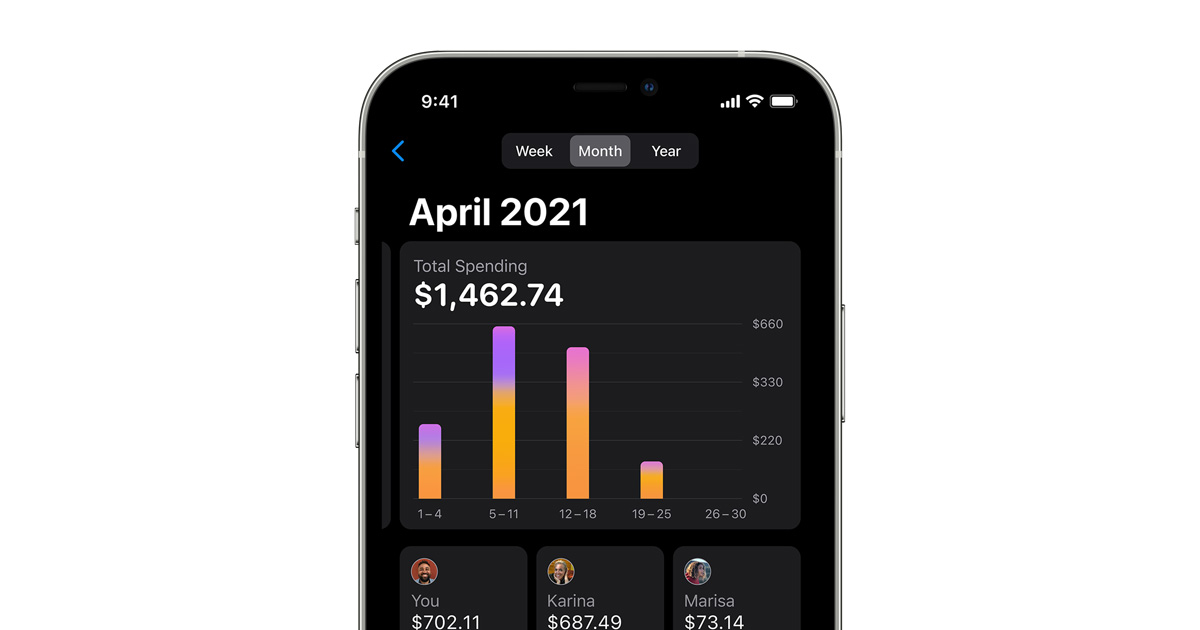

Apple Card offers experiences that are only possible with the power of the iPhone, including 24/7 support by simply texting Messages. To help people better understand their spending, use Apple Card machine learning and Apple Maps4 to clearly mark transactions with brands and locations in Wallet, and provide weekly and monthly spending summaries.

There are absolutely no fees associated with Apple Card: no annual, late, international or extraordinary fees.5 To help people make informed choices, Apple Card shows a range of payment options and calculates real-time interest charges on Wallet in different payment amounts.