Mobile applications provided by Alibaba Group Holding Ltd (NYSE: BABY) -supported Ant Group banned under an executive order issued by outgoing President Donald Trump on Tuesday.

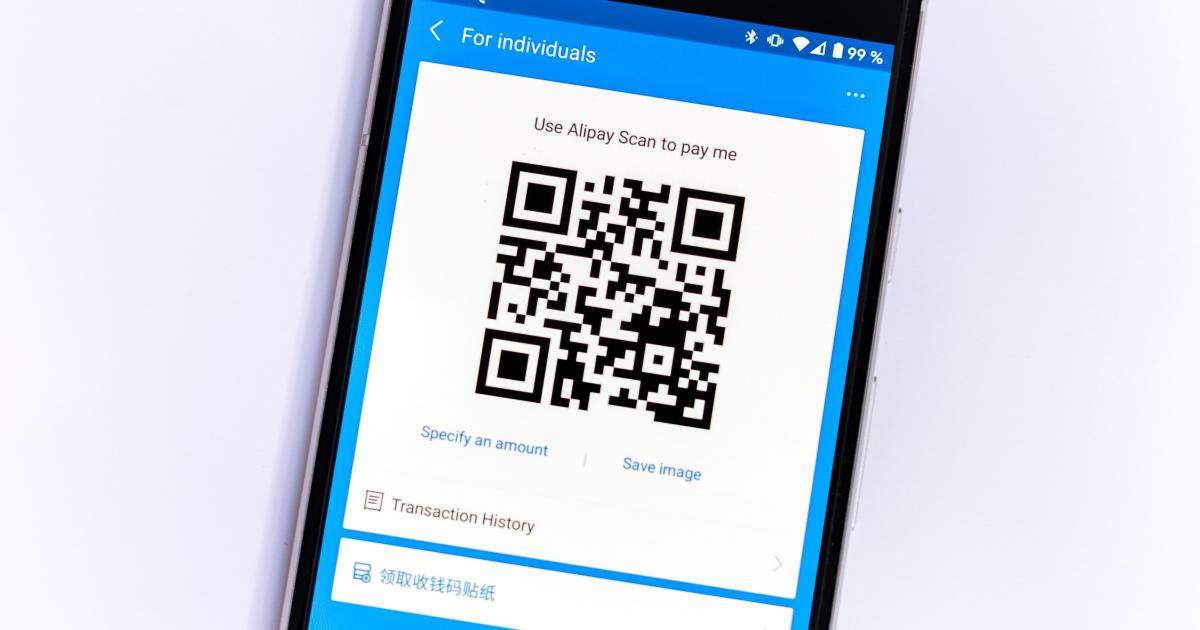

What happened: U.S. transactions with Hangzhou, China-based Ant Group’s Alipay, which had more than 1.2 billion users worldwide as of October 2019, will be banned, according to Xinhua.

The order only comes into effect after Trump leaves office, as it is expected to apply in 45 days.

Programs offered by Tencent Holdings Ltd (OTC: TCEHY) such as Tencent QQ and WeChatPay were also banned under the order along with CamScanner, SHAREit, VMate and WPS Office.

The order highlighted the threats of Chinese applications, enabling Asia’s power to track the location of federal employees and contractors and ‘compile dossiers of personal information’.

Why it matters: Trump’s move is the latest setback for the founding of Jack Ma, Alibaba, which is also facing an antitrust inquiry in China.

See also: Chinese financial regulators order Ant Group to refurbish business

Last August, Trump signed an executive order banning ByteDance’s short-running video app TikTok, unless his parent agreed to sell the app.

Subsequently, a federal judge issued orders to strike the ban on TikTok next month.

Oracle Corp. (NASDAQ: ORCL) and Walmart Inc. (NYSE: WMT) has agreed to acquire TikTok before legal aid.

According to the latest reports, Ant Group may be forced to sell part of its equity portfolio. Chinese regulators are also considering asking the fintech company to share consumer data, according to a report by the Wall Street Journal on Tuesday.

Price action: Alibaba shares traded 2.08% lower at $ 235.40 on Tuesday after closing nearly 5.5% higher at $ 240.40.

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.