The organization that says in the US whether the economy is in a recession or not seems to be asleep.

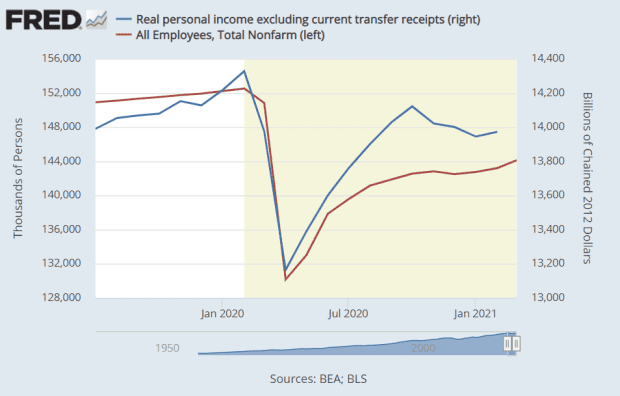

The National Bureau of Economic Research defines a recession as the period between a peak of economic activity and the subsequent valley, or its lowest point. There is no debate that the NBER was correct in mentioning the last cycle’s peak in February 2020, but if you look at unemployment claims, it was the end of April and no later than May when you look at jobs or personal income.

Employment and personal income are far above the manger.

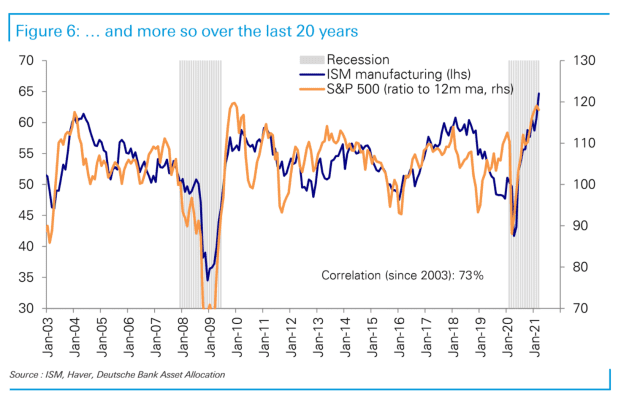

For markets, there is significance when the economy is in expansion or recession. According to research by Deutsche Bank, growth, measured by the manufacturing index of the Institute of Supply Management, usually occurs 10 to 11 months after a recession ends. That would be at the moment if you go by the NBER’s definition of recession and not the stubborn refusal to say so.

Over the past 20 years, there has been a correlation of 73% between the annual, rolling profits of the S&P 500 SPX,

and the level of the ISM Manufacturing Index. This makes sense – you would expect growth assets, such as equities, to be correlated with measures of economic growth.

According to Deutsche Bank figures, the S&P 500 sold at a median of 8.4% around growth peaks and fell at a median of 5.9% when the ISM flattened out instead of falling. And the timing of these drops was soon from its peak – usually two weeks later, lasting a total of six weeks.

It is therefore important to reach the climax. And Deutsche Bank says it will come in the next three months – not a big shock because the March reading recorded 64.8%, a 38-year high.

“As growth peaks over the next three months, we expect discretionary investors to compare their positioning of extremely high levels, and that retail investors are unlikely to buy the decline. Using historical experience as a guideline, it is argued for an almost -6% decline if growth nears the peak, a greater decline of -8.4% on a reverse V-growth, ‘strategists said below. led by Binky Chadha said.

From there, however, shares may rise back, they say. And the key in late summer and fall is whether inflation persists or accelerates, and how the Federal Reserve responds.

Lined minutes on deck

The minutes of the last Fed interest rate decision will be announced at 14:00 Eastern. The markets will focus on any discussion surrounding the timing of the slowdown in the rate of bonds, and how ‘significant further progress’ towards maximum job and price stability targets is defined.

Jeff Bezos, CEO of Internet retail giant Amazon AMZN,

supports raising corporate taxes to pay for increased infrastructure spending, reports The Wall Street Journal, citing a memo from the company. JPMorgan Chase JPM,

Chairman and CEO Jamie Dimon used his annual letter to advocate for stricter regulation of non-banking competitors, as he called for tax cuts to be eliminated and said higher taxes on the wealthy would be justified.

Travel operators including Carnival CCL,

and Norwegian Cruise Line Holdings NCLH,

expanded Tuesday’s gains in the pre-trade market as it is optimistic about when discussions can continue. Irish discount airline Ryanair Holdings RYAAY,

said that European travel restrictions would mean passenger traffic at the low point of its direction.

Industrial conglomerate Toshiba 6502,

jumped into Tokyo trading after receiving a proposal to be bought by CVC Capital Partners, which would be one of the largest private equity deals of all time if completed. The Singapore Food Delivery and Payment Service, Grab, is up for a $ 35 billion valuation in an agreement to be acquired by Altimeter Capital’s Altimeter Growth 1 AGC,

special procurement business according to the Financial Times.

Some DoorDash DASH,

according to Bloomberg News, workers are trying to use the algorithm to offer higher prices.

Subscribe to MarketWatch Investing in Crypto Opportunity.

10-year relief

The yield on the ten-year treasury TMUBMUSD10Y,

fell last week and reached 1.66% on Wednesday.

US futures contracts ES00,

NQ00,

was little moved.

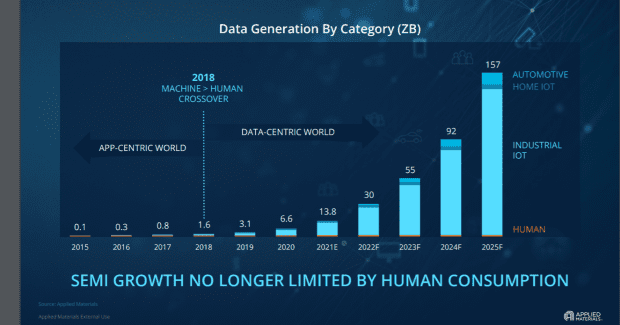

People no longer drive the demand for microchips

Manufacturer of microchip equipment Applied material AMAT,

on Tuesday set out its vision for the next few years, with fiscal 2024 earnings of $ 8.50 per share from sales of $ 26.7 billion. The market did not react warmly, but in one of its charts the demand for microchips is explained – driven by algorithms, not by human consumption.

Random reading

The owner of the world’s largest cryptocurrency exchange does not own a car or a house.

Singing in the alien rain? Extraterrestrial raindrops are like rain on the earth.

Need to start starts early and is updated to the opening clock, but sign up here to have it delivered to your inbox once. The version by e-mail is sent in the Eastern direction at about 07:30.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning investor briefing including exclusive comments from Barron’s and MarketWatch